Metalla was built to generate leveraged precious metal exposure by acquiring royalties and streams for our shareholders. Our goal is to increase share value by accumulating a diversified portfolio of royalties and streams with attractive returns. Our strong foundation of current and future cash generating asset base, combined with an experienced team gives Metalla a clear path to becoming one of the leading gold and silver companies for the next commodities cycle.

- Focused strategy of acquiring third-party royalties on assets owned by major mining companies

- A gold, copper and silver focused royalty company

- Free carried interest in a diversified portfolio of assets

- Guaranteed margins

- No exploration risk, mining risk, and project risk

- Topline cashflow

- Immediate cash flow from producing operations

- Exposure to the asset in perpetuity

- Exposure to top operators and assets in the world

- Leverage to the gold/silver price and growing business

Approach to Royalty/Stream Acquisitions

- Focused on precious metals and copper royalties

- Gold

- Silver

- Copper

Evaluation

- Management's operating track record

- Profit margin & position on the industry cost curve

- Counterparty risk, jurisdictional risk, technical risk

- Producing or near-term producing assets

- Compliance with the Group’s corporate social responsibility policy

Diligence

- Detailed due diligence on assets production profile

- Site visits by technical team and independent technical advisors local in the jurisdiction

- Production assumptions based on existing mineable reserves, resources conversion assumptions evaluated on case-by-case basis

- Consider other factors such as geology, infrastructure and permitting, which could impact production volumes or mine life

- Legal ownership, permits, licenses, operating agreements, titles, and corporate structure

Growth Strategy

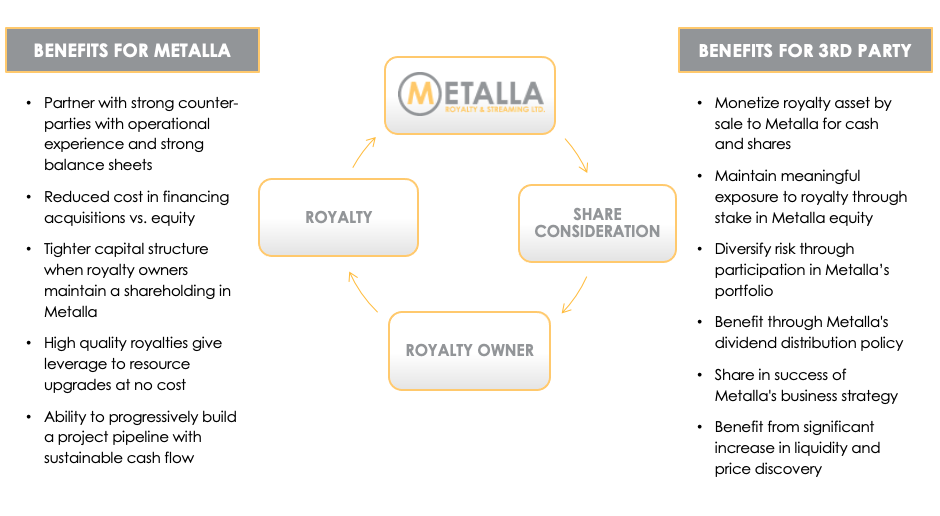

Royalty & Streaming Benefits

Metalla has employed a unique strategy in acquiring royalties and streams offering sellers a combination of Metalla stock and cash. This has enabled 3rd party vendors the opportunity to monetize their royalty interests in the most tax-efficient manner while maintaining meaningful exposure to the upside of their assets and also benefiting from the appreciation of Metalla's share price. This model has been validated through multiple transactions.